Well this has been an interesting month. My net for the month was +15.4 points which is a little less than 5 points short of my monthly goal of 20 points. I feel I traded the system well during the hardest parts of the month but failed to really capitalize on a few large moves.

The following table shows my trades and analysis for the month: February 2007 Trading Summary for Russell Futures (Actual) Date Trade 1 Trade 2 Trade 3 Trade 4 Net 2/1/2007 2.8 -1.7 -1.8 -0.7 2/2/2007 -1.8 -1.8 0.6 0.7 -2.3 2/5/2007 1.5 2.3 3.8 2/6/2007 -0.7 -1.8 -2.5 2/7/2007 0 4.2 4.2 2/8/2007 1.8 -0.7 1.1 2/9/2007 -1.8 -1.8 2/12/2007 2.5 1.2 0.1 3.8 2/13/2007 -0.6 -1.5 2.9 0.8 2/14/2007 -0.8 1.9 1.1 2/15/2007 -0.5 0.4 0.1 0 2/16/2007 -1.6 -1.1 -0.8 -3.5 2/20/2007 Simulated trades 0 2/21/2007 -1.8 0.3 1 -0.5 2/22/2007 -1.8 2.2 0.4 2/23/2007 0.8 0.8 1.6 2/26/2007 -1.6 2.8 1.2 2/27/2007 1.7 2.2 0.1 4 2/28/2007 -1.8 4.6 1.9 4.7 15.4 Largest Largest Average Average Win Ratio Winner Loser Winner Loser 57% 4.6 -1.8 1.59 -1.37

And the next table shows the system's trades for the month: February 2007 Trading Summary for Russell Futures (System) Date Trade 1 Trade 2 Trade 3 Trade 4 Net 2/1/2007 2.3 1 0.3 3.6 2/2/2007 -1.7 -1.1 -0.1 0.7 -2.2 2/5/2007 -0.9 2.5 1.5 0.2 3.3 2/6/2007 -0.2 0.5 -1.2 1.6 0.7 2/7/2007 -0.9 3.6 2.7 2/8/2007 1.1 0.1 -0.8 0.5 0.9 2/9/2007 0.1 0 1.3 1.4 2/12/2007 2.2 -0.2 -0.6 1.4 2/13/2007 -1.8 1.4 -0.4 2/14/2007 -0.3 4.6 0.4 4.7 2/15/2007 -0.1 0 -0.1 2/16/2007 2.8 2.8 2/20/2007 2.2 11.3 13.5 2/21/2007 -1.5 0.2 1 -0.3 2/22/2007 -1.8 1.5 -0.9 2.1 0.9 2/23/2007 2.3 -0.3 1.1 3.1 2/26/2007 -1.8 3.4 -0.1 1.5 2/27/2007 3 2 -0.7 1.9 6.2 2/28/2007 -0.7 3.1 -0.2 7.5 9.7 53.4 Largest Largest Average Average Win Ratio Winner Loser Winner Loser 60% 11.3 -1.8 1.92 -0.66

Even excluding the 20th which consisted of 13.5 points that still leaves a gap of 24.5 points between my actual trades and the system trades. I suspect that most of significant difference of this is due to missing a few large moves such as missing that 7.5 point move this morning.

For a week by week analysis, the actual trades are as follows:

Week 1 Week 2 Week 3 Week 4 Week 5

-3.0 +4.8 +2.2 +1.5 +9.9

And for a week by week analysis, the system trades are as follows:

Week 1 Week 2 Week 3 Week 4 Week 5

+1.4 +6.8 +8.4 +3.7 +17.4

Thus in terms of following the system I captured approximately 70% of the total profit in Week 2 (the best week in terms of trading the system) and -200% in Week 1 (the worst week in terms of trading the system). The remaining weeks average between 40%-50% of the total profits available. As I mentioned before it appears that the weeks where I failed to capture the percentage of profit available, I either missed or bailed out early of large winning trades. I tended to trade better during more choppy and difficult conditions. This will be something to consider and that I intend to work on next month.

Save to del.icio.us

Wednesday, February 28, 2007

Monthly Trade Analysis - February 2007

Posted by

Lord Tedders

at

2:49 PM

2

comments

![]()

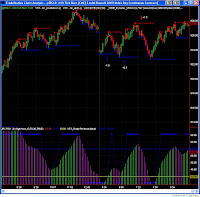

Russell 2-28-07

This morning premarket had some modest bullish sentiment that quickly faded after the first few minutes of the trading day. Bears came back out to seek yesterday's tremendous low but failed to hold any enthusiasum. As Dr. Steenbarger showed last night with his research large down days like this tend to generate bullish sentiment during a bull market and this seemed to hold true today as the most interesting moves were to the upside.

First trade of the morning was long at 6:32 at 792.00 for -1.8. This was a late entry on my part (by about a point) as the market started moving right from the bell quite quickly. Second trade of the morning was short at 6:38 at 791.3 for +4.6 points which was a nice little move down to test yesterday's low. I missed the third trade of the morning at 6:55 long at 787.7 for +0.7. Fourth trade was short at 7:05 at 789.7 for +1.9 which was a strong entry (I waited for the 55T RSX to indicate OB). Last trade of the morning which I also missed was at 7:15 at 788.00 long for +7.5.

Net on the morning: +4.7

With a couple of missed trades this morning I'm considering perhaps putting half of my position on at the initial entry candle and another half at a more advantageous price (if it occurs) when RSX on the 55T becomes OB/OS. I'll have to test this more, but certainly this morning it would have meant at least getting half my position on during some larger moves.

One of the recurring themes I see each week is that there are one or two pivotal days that make your week and on those days you need to be there for every market opportunity. The time to back off is not when you are doing well but when you are having a tough day or the market can't make up its mind. I think many beginning and even intermediate traders tend to want to do exactly the opposite. On good days we are anxious to keep our profits (and hence reduce our trading) and on bad days we trade just trying to make something happen. I will be keeping this in the foremost of my thoughts as we go forward.

Save to del.icio.us

Posted by

Lord Tedders

at

12:55 PM

2

comments

![]()

Tuesday, February 27, 2007

Russell 2-27-07

Well this was a pretty unusual and facinating day for the stock indices. After a very unusual overnight news event the market opened 15 points off. As I've mentioned before when you see a modest size gap, its often likely that the gap will fill during the day (even the morning). However, with gaps 3 points and above this becomes less likely as we saw today. Even though most of the action was in the afternoon, it was still a good day.

First trade of the morning was right from the opening candle at 6:32, a short reversal at 809.2 exited for +1.7. The second trade was a 6:49 long reversal signal at 807.6 for +2.2. Third trade of the day was a short reversal 7:07 short reversal at 810.2 for +0.1.

Interesting that on such a big down day that most of the profits ended up being from a long trade.

Net on the morning: +4.0

Save to del.icio.us

Posted by

Lord Tedders

at

5:39 PM

0

comments

![]()

Monday, February 26, 2007

Russell 2-26-07

Overnight activity on the markets pushed the Russell up, gapping up to Friday's open before quickly losing bullish interest. The market reversed and moved back toward's Friday's lows on strong bearish activity.

First trade of the morning was long reversal at 6:30 a.m. at 831.7 for -1.6. Second trade of the morning was short reversal at 6:49 a.m. at 829.00 for +2.8.

Net on the morning: +1.2

Save to del.icio.us

Posted by

Lord Tedders

at

2:14 PM

0

comments

![]()

Friday, February 23, 2007

Russell 2-23-07

The pre-market Dow and other indices were bearish going into today. The Russell gapped down from yesterday's close and showed early morning weakness. However, the Russell continued to be very choppy this morning and bearish enthusiasum was mediocre. I wouldn't be surprised to see us close at the highs of the day.

First trade was a short reversal at 6:33 at 829.50 for +0.8. This was one of those mornings (like yesterday) where it would be great to take off 1 contract after 2 points have been made. Second trade signal to go long occured at 7:58 but chose to pass on this signal because of the overall bearish outlook of the rest of the indicies. If I'd have taken it I would have lost -0.2. Third trade was a short breakout at 7:28 at 826.3 for +0.8.

Net on the morning: +1.6

Net on the week: +1.5

It's pretty obvious, but the major move for the week occured on Tuesday (I was on the simulator that day) and would have been worth about 11 points had I been trading it. The key to making this methodology work is to hold on and try not to lose too much during choppy days (like Wednesday - Friday) so that big R days can pay off.

Save to del.icio.us

Posted by

Lord Tedders

at

9:02 AM

0

comments

![]()

Thursday, February 22, 2007

Russell 2-22-07

The Russell opened the morning to slight weakness that was soon bought by bulls looking for another breakout above yesterday's close. After the 7:00 a.m. breakout failed, the ER moved back into yesterday's range. This was another fairly choppy morning with little follow through.

The first trade of the morning was a short reversal at 6:42 a.m. at 828.50 for -1.8. The second trade of the morning was short reversal at 7:19 a.m. at 830.1 for +2.2.

Some of you may have noticed that I've added a new indicator to my setup. This is actually an indicator I use to filter choppy trades called the VST Scalper. It is available from Viper Spreed Trader and I find it very useful.

Net for the morning: +0.4

Save to del.icio.us

Posted by

Lord Tedders

at

10:00 AM

0

comments

![]()

Wednesday, February 21, 2007

Russell 2-21-07

The premarket on the Dow was weak this morning and the Russell gapped down after yesterday's strong bullish activity.

First trade of the morning was a long reversal at 6:39 at 826.1 for -1.8. The second signal was a long reversal at 7:00 at 815.8 for +0.3. The third trade of the morning was a short reversal trade at 826.1 for +1.0.

Net for the morning was -0.5

Save to del.icio.us

Posted by

Lord Tedders

at

5:54 PM

0

comments

![]()

Friday, February 16, 2007

Russell 2-16-07

The morning opened up with little volume after yesterday afternoon's profit taking. After the bulls failed to take the morning above yesterday's value area, the market pushed lower.

First trade of the morning was a long reversal at 6:33 at 815.6 for -1.6. Second trade of the morning was a short breakout at 6:47 at 813.4 for -1.1. Last trade of the morning was a long reversal trade at 7:12 at 813.3 for -0.8. This mornings trading was a good example of how to do nearly everything wrong. It's important not to get psyched out when you've had one bad trade for the morning (the first) and then let it color your perceptions on subsequent trades.

Net for the morning: -3.5

Net for the week: +2.2

Because I failed to stick to my trading plan for the morning I will be on the simulator Tuesday.

Save to del.icio.us

Posted by

Lord Tedders

at

7:40 AM

2

comments

![]()

Thursday, February 15, 2007

Russell 2-15-07

After a very interesting day yesterday with afternoon action bringing us nearly back to the open yesterday, this morning opened to tight consolidation with little enthusiasum on either side.

First trade of the morning was a short breakout at 6:45 at 815.1 that had little follow up for +0.1. Second trade of the morning was a long reversal trade at 7:02 that I was a little late on at 815.1 for +0.4. Third trade of the morning was a short reversal trade at 7:25 at 815.50 and was exited (perhaps a little prematurely but with the chop it was a tough call) at -0.5.

Net on the morning: +0.0

Save to del.icio.us

Posted by

Lord Tedders

at

8:22 AM

0

comments

![]()

Wednesday, February 14, 2007

Russell 2-14-07

The premarket Dow and Russell had some slight weakness this morning and opened up lower than yesterday's close. The market made an attempt to retrace to yesterday's value area but failed to push lower. At around 7:00 a.m. the market surged based on Bernake's announcement and the bulls took over.

First trade for the morning was a short reversal at 6:35 a.m. at 815.70 for -0.8. Second trade of the morning was a long breakout signal at 7:05 a.m. at 816.4 for +1.9. I was a little late in on the 2nd trade due to the speed of this morning's news release.

Net on the morning: +1.1

Save to del.icio.us

Posted by

Lord Tedders

at

8:53 AM

1 comments

![]()

Tuesday, February 13, 2007

Designing a Robust Mechanical Trading Strategy

One of the questions that I often get asked about strategy design is, “how do you design a robust mechanical trading strategy?”

To understand how to build a robust mechanical strategy it is important to understand what a robust mechanical strategy is. A mechanical strategy is simply a quantified decision stream that leads either a “trading robot” or the trader himself to determine position size, entries, exits and stops all in a completely hands off fashion – in other words if you have a working mechanical system your input is not needed (or if so to a very limited degree). Additionally, for a mechanical strategy to be robust, it must capitalize on a “trading edge”. This can be anything from a statistical edge (trending) to an executionary edge (arbitrage). Furthermore, this strategy must hold up over an extensive period of trades historically (at least several hundred) and must hold up in future trading (which can be simulated).

A mechanical system has several advantages that discretionary traders do not such as the ability to perform quantitative and data mining analysis quickly and over extended historical periods. Additionally, mechanical systems can alleviate some of the emotional distress that accompanies discretionary trading – particularly among new traders. However, it is important to recognize that mechanical trading has several disadvantages as well. The first being that you must be able to quantify each and every trading decision that the system will make, secondly the mechanical system will have to be periodically adjusted (just like a discretionary trader adjusts their methods) either through inherent adaptivity, optimization, or diversification. Lastly, mechanical systems only work if one puts in the tremendous amount of time and effort required to program, test, debug, and continually adjust it.

To design any mechanical strategy it is important to consider three things before anything else: 1) your objective for that system, 2) your market, 3) your timeframe. Once you have determined this, it is easy to find your essential methodology because there are only 4 ways to trade any market: 1) trend trading, 2) momentum trading, 3) reversion to the mean trading, 4) and fundamental trading. Once you have determined your objective, market, timeframe and method you are ready to attempt to put together your first strategy. Many of you are probably thinking at this point, “what if I don’t know any of that stuff?”

If you are already an experienced discretionary trader this should not prove to be overly difficult. However, if you do not have extensive experience you will have to find a method that works. This method can be as simple as a moving average cross long/short to as complicated as a continually adjusting collaborative neural network that is genetically re-optimized daily. The very best way for the inexperienced trader to build a new system is to test ideas. This can be done in two ways – visually or programmatically. For someone without extensive programming experience, the best would be to start with what I call “candle by candle” back testing. This is performed by taking an idea (such as a moving average crossover) and testing it with historical data on the given market and time frame by moving your charts forward from the past into the future and trading the way the system would – without future knowledge of the markets.

This method is how I tested my first ten “strategies”, four of which I still continue to trade today (including two that were designed by Phil McGrew which I tested using this method and still trade today). Here is an example of how I tested Phil's indicators (with my own exits). However, I had to test nearly fifty or sixty ideas to get down to those ten strategies that work, and finally refine the process until I had found four of those ten systems that I found tradable. To give you an example of how time consuming this process is, I tested these ten strategies extensively often looking at over 2 years of 15 minute bars and “executing” hundreds of trades. I spent nearly 700 real hours doing this testing (and I’m pretty quick with a chart and excel). It sounds like a lot of work right? Well it was, but it also gave me a feel for those markets that is nearly as good as having traded those markets in real time.

After doing this for some time, I felt that there had to be a more effective way to test ideas. And there is – programmatic testing. Programmatic testing again can be very easy – a simple moving average cross is a simple thing to program in nearly any programming language. However, the difficulties that can destroy the beginning programmatic trader are nearly endless. Many popular trading packages do not trace your equity position tick by tick, rather it is tracked bar by bar (and if you’re trading daily bars you can imagine the problems). Also, ideas that I had tested extensively by hand sometimes were difficult to program. I have had so many experiences where I miscoded a critical concept (even by a slight degree) and this ended up giving drastically different results than my hand testing. Without the knowledge that it was the code that was incorrect, I might have falsely dismissed many trading ideas that were in fact valid. This coding problem is haunting if you think about it.

Additionally, at this level of programmatic trading it is very important to consider factors of minimizing inputs (degrees of freedom) and utilizing flexible inputs. An example of this would be to utilize a 3 ATR stop instead of a 60 pip stop so that as the prices and volatility of the market fluctuate your stop is not being taken out because of random noise. Other ways that you can improve the robustness of your strategy include utilizing realistic fills and commissions and ensuring that your limit orders would have actually been filled (this is not as easy to test in some software as it should be). Optimization is another useful tool to consider at this point in your strategy testing career. This is a powerful but two edged sword. Utilization of genetic algorithms and similar “hill climbing” techniques are a common way to ensure that your optimization does not give you a single point anomaly, but rather that there are similar input values surrounding your inputs that give similar equity graphs. Walk forward testing is another useful tool that can help you achieve realistic results and see for yourself whether a strategy would have been successful on data that was not optimized (similar to the future).

Going further into programmatic trading, after having experienced many pitfalls, I feel that I ought to be able to test more than one idea at a time. In fact, ideally I would like to test many ideas, over multiple time frames and multiple markets. Right now this is the work that I am involved in designing and I feel that this will help me analyze the markets with the speed and precision that will take my trading to the next level. This is the arena of the best strategy designers, where statistical data mining, market analysis, timeframe analysis, technical analysis, fundamental analysis, and money management are combined with realistic evolutionary testing into a single package.

As you can see, advanced programmatic testing and trading is a complex arena. I myself am still learning and by no means consider myself an expert. The good news is that successful robust mechanical strategy creation and implementation can be done in as simple or as complex a manner as you choose. After all, the very simple strategies tested and/or designed with candle by candle backtesting are still a cornerstone of my trading methodology.

Save to del.icio.us

Posted by

Lord Tedders

at

1:56 PM

5

comments

![]()

Russell 2-13-07

The premarket action especially on the Dow indicated early morning strength, and indeed the Russell gapped open approximately two points from yesterday's close. After initial bullish activity, the market stalled out at around 7:15 and then made a move to fill the gap.

First trade of the morning was a little premature. Short reversal at 6:35 a.m. at 811.50 was quickly exited at -0.6. I should not have been in that trade. Second trade was short reversal at 6:57 a.m. at 812.50 for -1.5. Third trade was at 7:15 a.m. short reversal at 813.50 for +2.9. This was a good example of having a morning where you've got the right idea, but you've got to wait for the tape. There were several signs (especially in the Dow) that the markets weren't ready for a bear move early on. It's important to recognize those signs and be patient - let the market come to you.

Net: +0.8

Save to del.icio.us

Posted by

Lord Tedders

at

8:52 AM

3

comments

![]()

Monday, February 12, 2007

Russell 2-12-07

After Friday's afternoon profit taking by bears, Monday morning opened up immediately with more bearish activity. This morning presented several excellent momentum opportunities.

First trade for the morning was a short reversal trade at 6:35 at 811.00. This trade was exited at 808.50 for 2.5 points. Next trade was a long reversal trade at 7:10 at 805.70 for 1.2 points. Last trade was a short reversal trade at 808.50 for +0.1.

Well I will say that this morning's trades were entered flawless and I'm very pleased with the low amount of heat I took in these trades. However, I feel in a way that I traded Friday (which was a losing day for me) better because the exits were no where near what my rules dictate. The first trade short should not have been exited until my second entry at 805.70 which would have meant an additional 2.8 points. The second trade should not have been exited until the third trade entered at 808.50 which would have meant an additional 1.6 points. The last trade was also exited prematurely.

After several hard days of making little if any points, it is very difficult to follow the rules. However, today is a clear example of why the those rules must be followed - especially when it is hard to do so. You only get opportunities like today once or maybe twice a week so when it happens you need to make the most of it. Today's net should have been +4.2 points greater than it was.

Net for the morning: +3.8 points

Save to del.icio.us

Posted by

Lord Tedders

at

1:22 PM

2

comments

![]()

Friday, February 9, 2007

Russell 2-9-07

This was another consolidation day and the market opened struggling to post new highs above yesterday's high of the 820.5 area, but falling back into a range after little enthusiasium.

First trade was long at 818.60 at 7:13 for -1.8. The importance of nailing your entry point was well demonstrated as this should have only been a -0.5 trade, but I was 4 ticks late on my entry.

Net on the day: -1.8

Net on the week: +4.8

Save to del.icio.us

Posted by

Lord Tedders

at

8:25 AM

2

comments

![]()

Thursday, February 8, 2007

Russell 2-8-07

The premarket on the Dow showed the early direction of the morning by gapping down from yesterday's close. After a large bullish move yesterday, the Russell focused on consolidation this morning ranging between the 818.00 and 814.00 value areas of yesterday.

The first trade of the morning was at 6:35 this morning short reversal signal at 817.20 for +1.8. The second trade of the morning was at 7:01 long reversal signal at 816.00 for -.07. I've really been focusing on my entry and exit mechanics and the first trade of the morning really exemplifies this. I was a little late on the entry of the second trade but I feel I exited the trade well.

Net for the morning +1.1

Save to del.icio.us

Posted by

Lord Tedders

at

8:10 AM

4

comments

![]()

Wednesday, February 7, 2007

Russell 2-7-07

The Russell opened above yesterday's close and then early on failed to close higher. Moving back into yesterday's range with little enthusiasum, the market moved back down towards yesterday's value area at around 7:00. After about 7:15 the bulls rechallenged this morning's high and then broke through and have subsequently moved higher.

First trade for the morning was a short reversal signal at 6:39 at 812.50 for +0.0. This entry was a little late and the market had little interest in moving significantly lower. The second trade for the morning was a long reversal signal at 7:00 at 812.40 that was exited at 816.60 at 7:40 for +4.2. Some of you may be wondering why I exited the trade "early" as the market is still moving up with good strength. The reason is that my rules say I "must" exit this type of trade setup when the RSX rolls over to a sell signal - of course I wouldn't be foolish enough to reverse my position on this market at the moment (7:50 a.m.)!

This morning is a strong reminder that you don't need too many multiple R days to make a lot of money.

Net on the day: +4.2

Save to del.icio.us

Posted by

Lord Tedders

at

7:44 AM

1 comments

![]()

Tuesday, February 6, 2007

Russell 2-6-07

The Russell opened at the top of yesterday afternoon's range and made three attempts to break out. After failing to breakout, this morning's market has made halting movements to attempt to find the bottom of yesterday's range.

First trade at 6:42 short reversal trade at 812.40 exited at -0.7. This should have been the winning trade of the morning but the third breakout attempt jostled me out of this position. I need to wait for a breakout to be confirmed before closing out of positions such as these. Next trade was long at 7:21 reversal trade at 811.00 for -1.8.

Net on the day: -2.5

Save to del.icio.us

Posted by

Lord Tedders

at

8:12 AM

0

comments

![]()

Monday, February 5, 2007

Russell 2-5-07

The Russell opened up showing no early downside follow through but after bulls failed to break to the upside at 814.00, bearish sentiment took hold in force. Funny but the morning market was just the opposite of the Superbowl where the Bears got stomped by the Colts.

First trade of the morning was a short reversal at 7:01 at 812.40 for 2.3 points. I should have rode this a little further (I could have squeezed an extra point). Second trade of the morning was at 7:21 at 809.5 for +1.5.

Net for the day: +3.8

Save to del.icio.us

Posted by

Lord Tedders

at

8:03 AM

0

comments

![]()

Friday, February 2, 2007

Russell 2-2-07

The Russell opened higher but without much enthusiasum. The market chopped back and forth without much follow through for most of the morning.

First trade of the morning was short regular signal at 6:39 at 811.10 for -1.8. Second trade was a breakout at 6:56 short at 809.70 for -1.8. Third trade was a long regular signal at 7:07 at 811.10 for +0.6. Last trade of the morning was short at 7:31 at 812.02 for +0.7.

Net on the day: -2.3

Save to del.icio.us

Posted by

Lord Tedders

at

9:03 AM

0

comments

![]()

Thursday, February 1, 2007

Russell 2-1-07

The pre market opened up on the YM with some bullish tendencies and was quickly followed with a strong gap open that was even more pronounced on the Russell. Today I really focused on taking all of the trades and letting them ride as per my system testing.

First trade was right from the open at 6:34 long reversal signal at 806.1 for +2.8. Second signal was a long breakout at 6:49 from 809.9 for -1.7. Third trade should have happend at 7:01 short at 808.4 for +1.1 but I missed this due to focusing on placing a forex trade at that time. Fourth signal was a long reversal at 7:39 at 807.2 for -1.8.

Net on the day: -0.7

Save to del.icio.us

Posted by

Lord Tedders

at

12:07 PM

0

comments

![]()